Applying for owner builder loans for the first time can be stressful if you are clueless of the things to expect. This is because lenders can be very particular in approving applications for these loans. But with proper guidance from lenders and brokers, this can become a very rewarding experience.

Applying for these types of loans can be very challenging because there are so few lenders that offer these types of loans in Australia. Apart from that, the number of requirements also often discourages potential borrowers to avail of these loans.

Things to prepare

Since applying for a home loan is a major undertaking, every applicant needs to assess their finance first. Lenders do this to ensure that applicants have the capacity to pay the loan. To do this, lenders require different documents to every loan application.

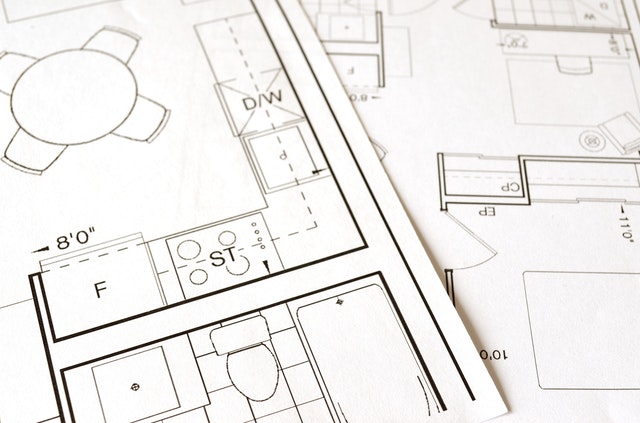

Applicants of owner builder loans will be required to submit many documents unlike the low-doc loans where applicants are required to submit very few documents. The documents that will be required upon application include the project’s drawings, amount already spent for the project and the amount needed to finish it. Upon application, applicants also need to prepare their proof of income, liabilities, and assets.

The majority of lenders in Australia also prefer that the borrowers are assisted by a licensed builder with their projects. If you are having a hard time preparing the needed documents, some companies can provide you with assistance in the preliminary stages.

Some companies provide customised service in assisting borrowers prepare the documents, find the cheapest and more flexible loans, and to ensure high probability of approval. Some provide assistance from council approval to construction cost estimates.

Borrowers are also required to get an estimate of their project before applying for the loan. In this document, borrowers need to specify the cost on each phase of the project (materials and services needed). The accuracy of this document needs to be confirmed and validated by a bank valuer or property surveyor.

Application process

The application process for the owner builder loans is divided into two phases: affordability aspect and valuation. After your loan application has been pre-approved, you need to prepare the validated cost estimate worksheets along with the supporting documents to the lender for approval. Make sure that you had your cost estimate validated by a bank valuer or property surveyor before proceeding to the next step.

Keep in mind that once approved, builder owners are required to contribute 20% of the total project’s cost. This amount, however, varies from lender to lender. So before even considering applying for this loan type, make sure you have funds ready at your disposal.

Getting help

If you think the documents required and the entire process is overwhelming, you can consider getting help from professional brokers on your next home loan. Some brokers in Australia offer a wide array of financial services to clients seeking different types of loans based on your needs Intellichoice brokers specialize in this field.

These companies can help you generally in different phases of your application, from start to finish. Intellichoice offers free loan appraisals, assesses your financial condition, helps you prepare the documents needed for your application, facilitates the submission of your documents on your behalf, and helps you find the best interest rate and terms in the market so you could start to build your own home.