Taking out a home loan is the biggest investment you can ever make in your lifetime. When taking out a home loan you know that there are many factors to consider in order to make payments on time and without delay.

Most borrowers’ first concern is the total cost of taking out a loan. There are many factors that affect the true cost of the loan. Aside from principal amount and the interest, other factors include deposit amount, the term of the loan, and other ongoing charges. All these will add up to your monthly repayment.

In order for you to calculate the actual cost of your mortgage, there are useful tools made available by most of the lending institutions on their website. You can use these tools to get a possible estimate of how much you can borrow, the actual interest on top of the amount you borrowed, and your required monthly repayments.

The Home Loan Repayment Calculator

A home loan calculator is a good tool that can help you estimate what your monthly repayment will look like. Home loan calculators consider the following factors – Loan term,

The interest rate, Payment frequency, and Repayment type. All these factors are important to provide you the closest estimate of your monthly repayment.

A home loan repayment calculator makes use of a formula that considers the principal, original amount borrowed, interest rate, and the number of payments throughout the life of the loan.

With the help of this financial calculator, you can measure if you are indeed financially capable of repaying a loan. This can also help you adjust on certain aspects in your finances to be able to afford a home loan repayment scheme assigned to you by your lender.

Major Factors To Consider To Calculate Actual Cost of Your Mortgage

- Loan amount. The total amount borrowed. The principal amount. Or the original amount borrowed.

- Loan Term. The life of the loan. How long is the life of the loan until it is finally paid off? Note that the longer the life of the loan, the higher the total amount you are going to pay for the loan. The shorter the life of the loan, the lower the total amount you are going to pay for the loan.

- Interest rate. The annual percentage of the outstanding loan. This should be divided into 12 months to get the monthly interest rate.

- Loan fee. This is charged by the lender. This could be a fixed amount of dollars.

- Repayment frequencies. Regular payments made to the lender which could be monthly, quarterly, semi-annual, or annually.

- Loan type. Is your loan fixed at interest and principal monthly payments? Or is it at interest only payments at a specific period of time and then principal payments after?

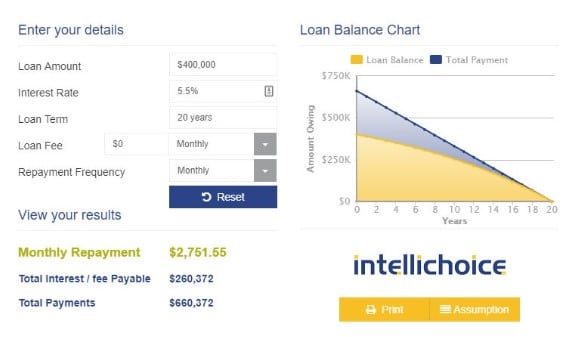

For the purpose of example, let’s say that you have borrowed a total loan amount of $400,000 with a 5.5% interest rate. Your loan term is at 20 years with $0 ongoing fee and no monthly repayment frequency. Your loan calculator will calculate the loan as follows, please see image below.

Your monthly repayment will be $2,751.55. The total interest payable on the loan is $260,372. The total payments that’s going to be made are $660,372. The loan repayment calculator is easy to use. This can help you actually compare interest rates and other features offered by different lending institutions so that you can make better decisions in mortgage loans.

Why must you use a home loan repayment calculator?

A home loan repayment calculator is an excellent tool that may help you better manage your home loan repayments and repay your mortgage on time.

If you are still looking for the right loan to purchase a home, the home loan repayment calculator is a tool you can use to help you compute the monthly repayments for various home loan amounts. This gives you an idea of the type of loan you can afford without jeopardizing your monthly finances.

For those already have a current home loan, the loan repayment calculator can help you determine what you new repayments would be if you have decided to have the mortgage refinanced. Also, you can track repayment amount when interest rates fluctuate through the life of your mortgage.