Land and construction loans can help you achieve your dreams of owning a house and lot. These types of loan allow you to make progressive payments as needed as opposed to having to pay full payments. You can purchase

The Application Process

To apply for a construction loan, you need to have a good to excellent credit score, a low debt-to-income ratio, stable and regular income, as well as an estimated and appraised value of the house plan.

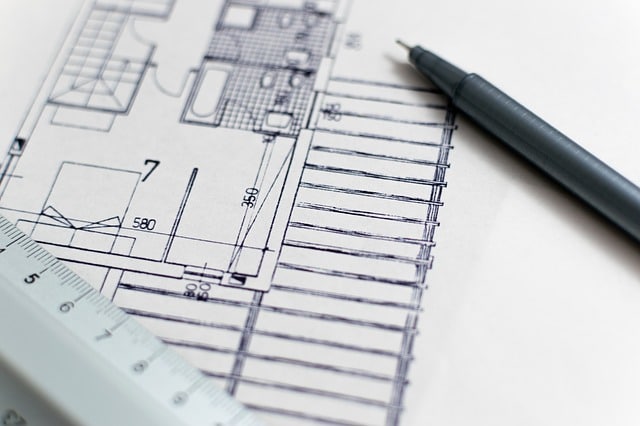

During the application process, lenders will require construction plans which includes complete costing for the entire project and the timeline for completion. Your lender will also like to see a licensed and qualified builder is enlisted in the building process. Expect to give a down payment ranging from 10% to 20% of the total cost.

Applying for a construction loan may take time. As construction loans take a lot of risks, lenders are more careful in reviewing applications. To speed up the process and to have a better chance of approval, you will want to provide a thorough construction plan.

You can also elect to work with a builder as recommended by the lender. Note that the lender will be involved in the entire process as money will be disbursed only after the completion of each building stage. An owner builder should connect with their lender or financial service for better coordination as well.

Land and Construction Loans Structure

Please note that land and construction loans differ in loan structure compared to standard home loans. Let’s take a look at the structure of construction loans to fully understand how it works. The objectives of your financial situation matters as much or even more when interest rates are taken into consideration. Land loans can be far so different from how other mortgages works.

In construction loans, each distribution is referred to as a draw. Multiple draws are generally spaced throughout the project known as progressive drawdown. That is, you withdraw from the loan amount as necessary to spend on the construction development obligations.

The draw schedule is determined by an agreement between the bank, the builder, and the buyer in such a way that draw dates will match the timeline of the project and meets the requirements of each party involved. Also, expect the banks to inspect and assess the project before every draw.

How much can you borrow with a construction loan? The loan amount to borrow is based, to some extent, on the property value of the home after construction had been completed. A construction loan, in most cases, follows interest only repayments over the period of 12 months. It will revert back to standard payments (principal and interest), after the first 12 months. This may be the same as that of a home loan, depending on your lender.

How Does Progress Drawdown work?

As soon as the lender approves the construction loan, property construction can commence. Lenders release funds through progress drawdowns or progress payments throughout the entire duration of the project. Progress payments are usually released upon completion and approval (by the lender’s assessor) of each stage as follows:

The slab down or the base. The funds released at this stage will help complete the foundation of the house. This includes ground leveling, plumbing, and waterproofing.

The frame stage. After the lender’s assessor approves completion of the slab down stage, lenders will release funds for the framing stage. This involves building the frame of the house. It includes part of the brickwork, roofing, trusses, and also windows.

The lock-up stage. Funds released at this stage will cover the external walls, windows, and doors.

The

The finishing and completion stage. Funds at this stage are for any finishing touches in plumbing, electricity, and all-around cleaning. It also includes the final payments of items that had been used in the contract.

Interest and payments

Interest and repayments are computed based on the funds used. For example, if the approved loan amount is at $350,000 and only $200,000 had been drawn on the fourth stage of construction, then only $200,000 will be charged an interest.

Important note: Lenders will only allow succeeding draws if all the funds drawn in the previous stage had been used up.

Land and construction loans are the best way to acquire land and finance a home construction project. It takes a lot of hard work and paperwork but the whole process pays off once approval had been granted.