Many observers say that the Single Parent Family Home Guarantee (SPFHG) is doomed to fail. How will it impact future home loans?

Many observers say that the Single Parent Family Home Guarantee (SPFHG) is doomed to fail. How will it impact future home loans?

Intellichoice Finance has been in the forefront in providing owner builder loans assistance to hundreds of clients with our team of professional brokers.

Australia’s ANZ raises its interest rate for all its long-term home loans, the most competitive in the market. How will it impact future homebuyers?

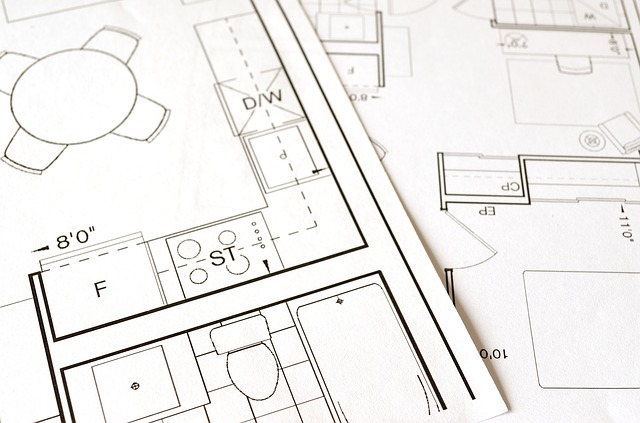

Owner-builder loans are loan products specifically designed to borrowers planning to build their own house. Unlike any other types of loans, these loans have specific requirements that every potential borrower needs to prepare. Building your own house or doing major renovations can be both stressful and overwhelming. Without any idea of this process, hiccups along […]

Everyone wants to own their dream house, but not everyone is lucky enough to be eligible for most loans due to negative finance history. That is why bad credit home loans attract many borrowers with bad credit scores. Not all preconceived knowledge about these types of loans are accurate. The truth about bad credit home […]

Applying for a loan to build your dream house with a bad credit score seems impossible, but not with low doc construction loans. This loan type is also ideal to developers,builders and some investors who don’t have the commonly required tax or financial documents ready at their disposal. Building one’s dream house is a significant […]

Applying for owner builder loans for the first time can be stressful if you are clueless of the things to expect. This is because lenders can be very particular in approving applications for these loans. But with proper guidance from lenders and brokers, this can become a very rewarding experience. Applying for these types of loans can […]

Property valuation is the key to determine if the house you intend to sell or the home you intend to buy is indeed a good buy and within the current prices in the market. What is the Value of a Property? An estimate on the value of the property you are selling or buying is […]

There are different types of home loans. Distinct terms and conditions apply in particular mortgages making it different from one another. The process of applying and getting a mortgage approved also differs and depends on how will you use your property purchase. Will it be an investment or are you planning to make a home […]

Buying a home, through a loan in Australia has now become easier, even in the prime locations and cities of the continent. Cost of purchasing a home in main Australian cities such as Melbourne, Sydney, Brisbane, Canberra, and Perth have decreased since the beginning of 2019 up to March of this year. It is still […]

What happens when you miss a home loan repayment? Before you are faced with this situation, you should act fast even before or after missing a home loan repayment. If you feel like you won’t be able to fund your check or if you are honestly going to be late for loan repayment, fix the […]

Moving to your new home is exciting. Finally having a place you can call home is personally satisfying, it is an achievement. However, moving to a new home is not always easy. Depending on the things you own, and the furnishings you would want to include in your new home, you may have to pack […]

Getting a home loan approved and repaying for one is a tough feat, even to those with good credit standing. Easier repayment scheme begins with getting a low mortgage rate approved on your application. Here are some tips you can follow to reduce your home loan rates and get the best deals possible for your […]

Applying for a refinance home loan is a good step to improve your finances. However, there are a few things to consider to fully maximize the advantages of a home loan refinancing. Getting a good grasp on how your home loan works make it easier for you to weigh if merging your personal loans into […]

Beginning a new year in a new home would be a great gift for yourself and your family. However, buying a new home is not a walk in the park even if you have the resources to do so. Buying a home involves a process, and the process may take longer if you require home […]

Are you looking into investing in property through a home loan? There are several factors to consider when investing in a property, even more, when you are financing this purchase via a home loan. An investment property is an ideal venture you could explore when aiming to put your money into something that grows and […]

It is a hard fact that home buyers are confused on the first steps to take in purchasing a new home. The main reason is that there’s a huge range of option to choose from. Choosing the right one can be confusing in terms of rate, loan terms, and features. The vast range of home […]

A reverse mortgage is a form of mortgage that is created specifically for retirees and those who are receiving pension. They are generally referred to as rich in assets but poor in cash. This type of loan is also referred to as senior’s finance or senior’s loan. You can practically purchase an investment property, through […]

Just about all loan providers have particular requirements for assessing a mortgage application. This specific set of criteria will establish approval of your application. There are numerous loan companies to pick from, a few have a few things added, however, the majority have similar specifications for the borrowing party. Below are a few of the […]

Building a career and reaching for your dreams may require working overseas and leaving Australia. However, even while building for the future, the typical Aussie would want to go back and call Australia their home. Here is where getting a home loan when living overseas comes in the picture. It is possible to secure a […]